In an increasingly turbulent financial climate, traditional banks are raising the lending barriers for small businesses, leaving countless enterprises in a financial lurch. On the flip side of the coin, Fintech lenders have emerged as invaluable allies for these businesses, leveraging innovative technologies to provide alternative and often more suitable loan solutions.

As the economic aftershocks of the pandemic continue to reverberate across the globe, banks have become increasingly risk-averse. Traditional lenders have tightened their credit policies, and small businesses often find themselves on the wrong side of these stringent risk assessment models. By focusing predominantly on credit scores and collateral, banks often overlook the unique nuances and potential of small businesses, leaving them stranded in their quest for capital.

Yet, in the shadow of these towering financial institutions, Fintech lenders are pioneering a more inclusive approach to lending. Fintech platforms, like YesMrBanker.com, harness the power of technology and data analytics to offer a holistic credit assessment that considers more than just the credit score.

“Our lending model prioritizes the unique aspects of each business. We don’t just look at credit scores; we evaluate business performance, cash flow trends, market potential, and other factors traditional banks might ignore,” says a representative from YesMrbanker.com. “We believe in the potential of small businesses and are committed to helping them find the right financial solutions.”

Fintech lenders also outshine traditional banks in the speed and ease of the loan application process. Unlike conventional loan applications, which can take weeks or even months, Fintech platforms employ sophisticated algorithms and AI technologies that can expedite the loan approval process. Small businesses can often access the required capital within days, a critical factor for those facing immediate cash flow problems.

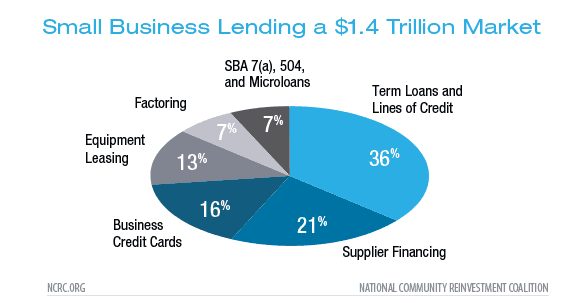

Moreover, Fintech lenders are offering a variety of loan products tailored to meet the specific needs of small businesses. From merchant cash advances and term loans to lines of credit and equipment financing, these lenders are expanding the financial toolkits available to small businesses, giving them more options to navigate their unique financial challenges.

These platforms also create a more customer-centric experience. While banks often seem distant and impersonal, Fintech companies work to understand the unique needs of each business and offer personalized solutions. They are not just lenders; they are financial partners who invest in the long-term success of their clients.

The rise of Fintech lending in the small business space signals a broader shift in the lending landscape. As banks erect higher walls around their lending policies, alternative lenders are breaking down barriers to create a more inclusive financial ecosystem. It’s a shift that promises to stimulate economic growth, promote entrepreneurship, and foster innovation, even in challenging times.

As small businesses continue to weather the storm, the importance of having accessible, tailored, and swift financial solutions cannot be overstated. In the face of banks’ increasingly rigid lending practices, Fintech lenders are stepping up, providing an essential lifeline to the small businesses that are the lifeblood of our economy.

As we move forward, the role of Fintech in shaping the financial landscape will become increasingly prominent. Their innovative, customer-centric, and inclusive lending practices are not just a response to current economic challenges but a blueprint for the future of finance.